By Brian Prater

In the community investment sector, we have succeeded in offering innovative capital investments that are focused on one component of our work, such as affordable housing or small business. However, we have struggled to finance more complex solutions that address the broader strategic needs expressed by communities and their residents. This narrowness has occurred for a number of intentional and unintentional reasons, including public sector requirements and constraints, risk tolerance of important capital partners, and, in some cases, implicit bias and racism. To build more equitable, vibrant, and resilient communities, we must change how capital is invested towards a higher impact and more just and holistic approach.

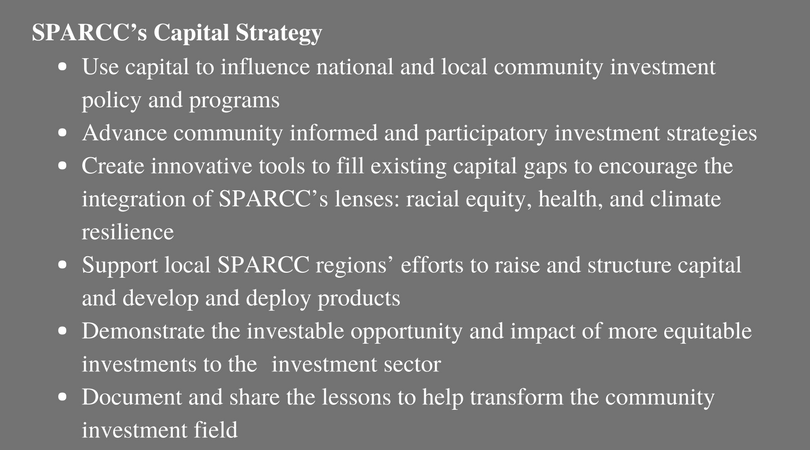

SPARCC seeks to be a voice in broadening the way we think about investing with community partners. SPARCC’s capital goals are ambitious, both in their scale and impact. We are attempting to use innovative capital strategies as a platform to integrate racial equity, health, and our responses to climate change. At the same time, we are also trying to change outdated systems and practices, including influencing key policies and programs, attracting more private capital to multi-sector projects, and empowering the community to be at the table when key decisions are being made. So how do we make sure that SPARCC’s desired outcomes are connected to how capital is deployed, and that the SPARCC-funded projects are transformational?

We have created the SPARCC capital screen, a tool designed to push ourselves to be innovative and discover new ways to promote equity through the projects we fund, both in process and outcome. The SPARCC partners, funders, and representatives from the six sites collaborated to develop this tool so that SPARCC capital can be intentionally aligned with a site’s objectives and outcomes. We will be the first to say that the screen is a beginning step and plan to evolve it as we learn and apply it to projects. But it’s a start, and we hope that it contributes as an approach in better tying investments to community impact.

Here’s how it works. When a SPARCC site is seeking financing for a proposed project, like affordable housing, green infrastructure, or a healthy food store, they submit their responses to the Capital Project Screen Survey as part of the underwriting process. SPARCC assesses the survey responses against 12 criteria in the capital screen. In developing their survey responses, the sites have full access to the screen and a resource guide that explains the thinking behind the 12 criteria and the scoring system. The scores for the survey response can range from 0-34 points and attempt to identify a few important items:

- How the project supports the vision of the SPARCC site team. Each of the six SPARCC sites has a vision that will help transform their region. The proposed project should be strategic and advance the larger mission. Our goal is to use capital as a tool in service to a larger strategy, not just an investment opportunity. For example, if the region’s vision is to end displacement, we’d look for how the proposed project prevents displacement and does not unintentionally exacerbate the issue;

- Integration of outcomes. How does the project integrate and advance SPARCC’s three lenses – racial equity, health, and resiliency/sustainability? A series of questions calls out each of these elements and asks how the project will address them. For example, one question asks how a project will improve certain elements of the social determinants of health;

- Community ownership and support. The screen asks how residents and the community have informed the project’s conception and design and how they will be involved going forward, particularly those groups that have been under-represented in the past; and

- System Change. One of our main goals is to align investments to impact by funding transformative, integrated projects that produce social benefits and are credit worthy for traditional lenders and investors.

These are big, complex ideas that we’ve condensed into 12 criteria in the SPARCC capital screen. We recognize some inherent challenges with such a holistic, comprehensive approach. First, real estate projects that provide social benefits (i.e. lower rents) usually have very tight budgets and already involve public sector subsidy. We understand tight economics and the existing positive impact of those projects. Therefore, we don’t want the screen to be used to prescriptively add features that make the projects unfeasible. We hope the screen is an opportunity for project partners to take a step back and identify how they can deliver the best, most integrated process and results possible. For example, the site could explore cost-effective strategies to promote active spaces in a project that also promotes resident health. Second, we also know that real estate projects take planning and that many of the projects in the current pipelines of the SPARCC places have been in development for years. We hope to open discussions about planned projects now by asking the questions in the screen, while also helping to seed ideas for the next round of projects that can be conceptualized and resourced in more integrated, inclusive ways.

In conclusion, I invite everyone to take a look at the SPARCC capital screen, and see if the tool and/or its questions resonate with you. We believe that there are many important conversations to be had with all of our partners: community, public sector, nonprofits, and the private sector. We hope it spurs dialogue, and we can learn from each other going forward.

Brian Prater is the Executive Vice President of Strategy, Development, and Public Affairs at the Low Income Investment Fund.

Download the SPARCC Capital Screen, Guide, Survey & Tool